Much has been written around the recent changes landlords now face regarding mortgage interest relief. The Conservative government believes it is necessary to re-balance the buying power of the average Buy to Let landlord. And they have a lot to say over how this can be achieved. Apparently the best way is to restrict the amount of interest landlords are able to offset against their profits. The belief is that this will help prevent landlords pipping first time buyers from buying the lowest value properties.

The new mortgage interest relief changes came into partial effect in April 2017 are due to be fully implemented by 2021. The new rule is to be phased in at 25% increments over four years. And with the first 25% restriction coming into effect from 06 April 2017 many landlords are rightfully worried over what this will mean for them.

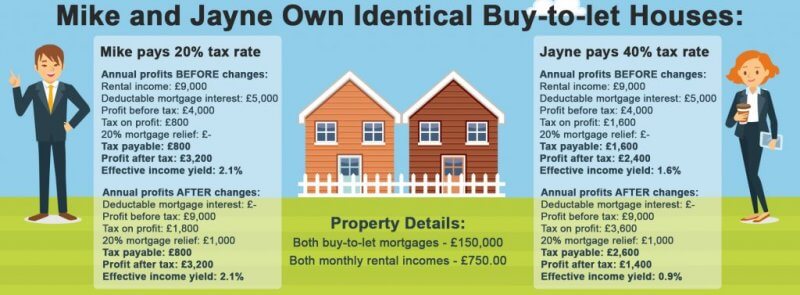

Under the new rules, the change will mean that many landlords will ultimately pay more income tax. Previously, the amount of income tax payable was calculated against net profits only and this tax would be due based on the highest rate of income tax for the individual.

What is the plan for mortgage interest relief?

Back in 2015, George Osborne, former Chancellor, announced the plans to change the way landlords pay tax. The policy, gradually phased over four years, will require tax to be paid on total turnover rather than profits. Landlords will be unable to deduct their total mortgage interest costs from their rental income when calculating the level of income tax to pay. Rather than just taxing the difference between income and mortgage interest, the full rental income will be taxed.

How will the change be implemented?

From 06 April 2017 only 75% of mortgage interest can be deducted from total rental income. Each year this percentage will decrease by a further 25%, until 0% can be deducted in the 2020-21 tax year. This, however, does not include allowable expenses which will still be covered. This rate will be fixed at 20%, meaning all landlords who pay 40% or 45% will be paying more. Additionally, some basic-rate tax payers will end up paying more too, because they may be pushed into a higher-rate bracket. Take a look at the image at the top of this post to see how an individual can effectively be pushed into a higher rate tax bracket.

Effects of the mortgage interest relief amendments:

After the ‘second home stamp duty levy’ was introduced in 2016, the buy-to-let market has in fact remained fairly resilient. It would seem that there are a hard core of professional Buy to Let investors that have gone out of their way to continue building their portfolios. Some have taken more serious measures to incorporate their portfolios into newly established Limited companies. The reason for this being that Limited companies are not subjected to the same taxation rules. Landlords can continue to offset their entire mortgage interest costs – for now.

Industry comments

Some say that the Buy to Let sector could suffer in the future. More recently, one industry commentator said ‘we could see landlords opting to come out of the private rented sector. With the threat of rising mortgage rates, many landlords could be left with nothing. Higher-rate tax payers with a 75pc or more mortgage interest will see their returns drained by 2021. If fewer landlords stay in the private rented sector, we can expect to see increasing costs or a lack of supply. Consequently, rental prices could increase as supply and demand become unbalanced. If rental prices start increasing it won’t just be landlords who face the effects. Renters, first time buyers and second steppers will also be hit by the change’ (Glynis Frew, Hunters Property Executive).

And so with the changes in mortgage interest relief taxation we will undoubtedly see some landlords facing one of the following:

- the amount of tax they pay on their income rising by at least double

- all, if not more, of their profit being paid in tax as the tax rate payable increases to above 100pc

- getting pushed into a new, higher-rate tax bracket, meaning they must pay more

- being left with losses rather than a profit, limiting them in maintain their properties

To find out more about the government’s strategy behind mortgage interest relief simply click here.

We hope you have found this post informative. Should you want to make a comment please leave one below and we will be sure to reply.

Alternatively you can visit us online here.